Whisper it in case the bank lobby hears: bank capital is good for the economy!

With the 2024 European elections coming into view, representatives in the European Parliament are looking for policy proposals to boost employment and industrial growth in their constituencies.

One of the best ways for them to achieve this is simple: commit to supporting stronger capitalised banks.

Europe’s firms and factories rely heavily on bank financing. When banks are strongly capitalisedThe more capital, or equity, that banks use to fund themselves, the more losses they can absorb and the stronger their balance sheets. The minimum amount of capital a bank can have is determined by regulation., these businesses can invest more. Strong banks will also help the EU to finance its sustainable transition.

What does the data show?

We can see exactly what happened when the minimum requirements for bank capital were raised by a few percentage points after the global financial crisis.

In short, lending to firms and factories got stronger.

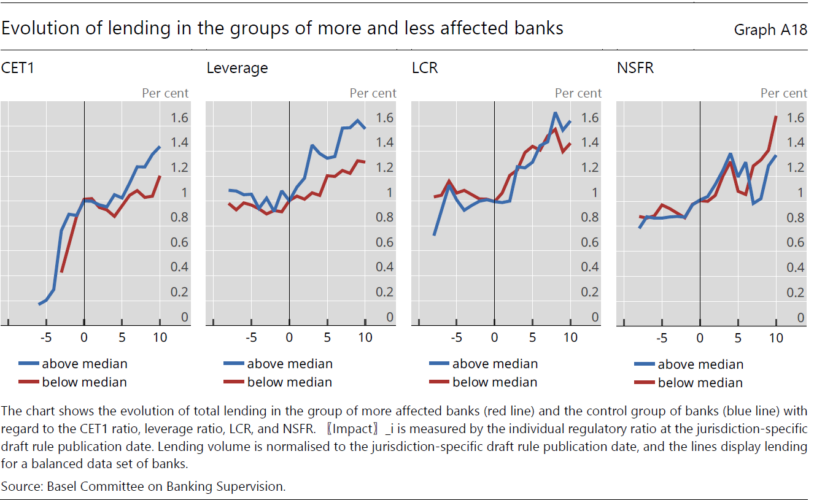

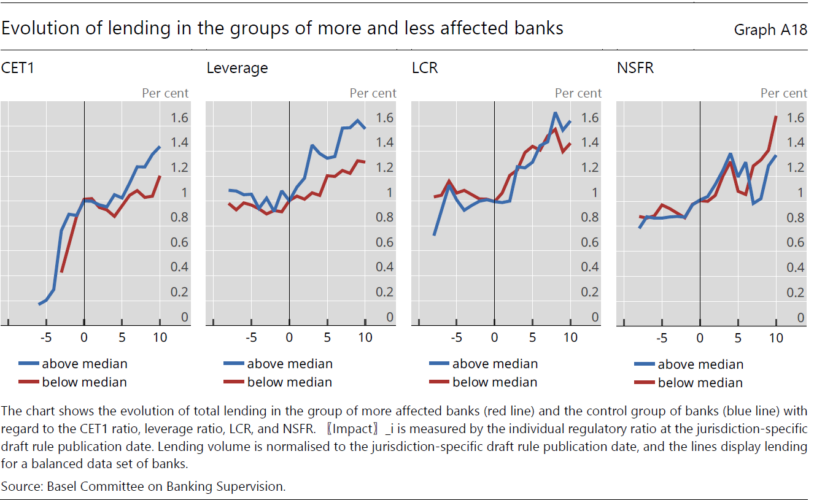

Impact of the Basel III reforms on bank lending – Source: Study by the Basel Committee on Banking Supervision

The latest in a series of studies from the Basel Committee for Banking Supervision (BCBS) shows that, even during the challenging years after the crisis, even when demand for credit fell, the Basel III reforms helped European banks to support their national economies. The BCBS study adjusts for GDP, market volatility, and interest rates, focusing only on how Basel III reforms impacted lending.

The BCBS study found that banks with more robust capital ratios were more reliable lenders, better able to increase their lending, and less likely to damage communities by going bust. It confirmed an earlier study by the Bank for International Settlements (BIS) that found banks were moving to higher capital levels mainly by retaining profits, not by cutting lending. In fact, bank lending grew in aggregate.

(Our) analyses do not indicate that the reforms have reduced the aggregate supply of credit to the economy, as the overall level of bank lending expanded in most jurisdictions during the implementation of the reforms.

Now that they have stronger balance sheets, Europe’s banks enjoy a lower cost of capital for their own equity and debt funding, which helps to boost their profitability and their ability to grow lending in future.

That is the empirical evidence from central bank data, collected from around the world and analysed in depth by the BCBS. It is based on what actually happened from 2011 to 2019, not on the predictions of economic models, which can so easily be programmed to give a particular answer or skewed by wrong assumptions.

The empirical facts are the opposite of the predictions of the financial lobby and its legion of consultants. This contradiction raises questions about the methods and messages of the banking lobby. In future, their claims and predictions on this topic should not be trusted.

Stronger banks will help to build a stronger economy

Basel III has helped to move things in the right direction, but bank capital still needs to be increased. Capital increases will be on the agenda again at the next banking crisis, or ideally before. When they are, banks will probably protest again, reflecting a culture of meeting internal “return on equity” targets by cutting their own equity.

But thanks to this important BCBS dataset, policymakers can focus on what matters for them and the EU economy – stronger banks mean more robust firms and factories.

Greg Ford

Finance Watch Senior Advisor